Its election season again, it seems that this year Donald Trump, the real estate mogul, won continuous public attention with progressive policies and bold sayings. Although some of his statements were ridiculous and quite inconsistent, Mr. Trump was right about one thing – the broken Campaign finance system–“I will tell you that our system is broken. I give to many people,” he said. “I give to everybody, when they call I give, and you know what? When I need something from them, two years, three years later, I call, they are there for me.”[i]

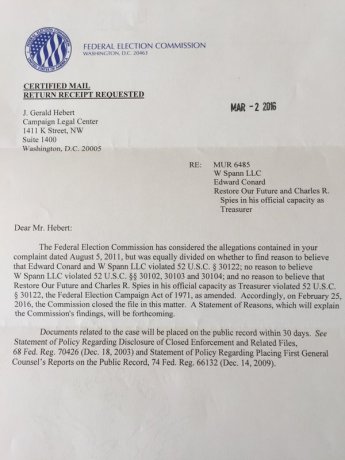

Whether Trump could get the support as he stated is unclear, but the chaos of campaign finance is definite. Especially with a deadlocked FEC decision March 5th regarding the complaint filed by Campaign Legal Center about the shell groups funding the Romney Super-PAC. Yes you are not reading this wrong, and Romney is not campaigning for president this year, because the complaint was filed 5 years ago regarding the 2012 Romney campaign.

Let us briefly review the case. During the 2012 election cycle, three shell companies were set up to transfer $1 million apiece into the super-PAC supporting Mitt Romney, known as Restore Our Future. Two organizations donor identities were obscured behind a mysterious office suite in Utah, and the founder of the third shell group voluntarily revealed himself to the media as a former partner of Romney’s at Bain Capital. He admitted that putting $1 million in to W Spann LLC which then directed the case into Romney’s super-PAC.

Our campaign finance law clearly stipulated that donor cannot make political contributions in another person’s name. Besides the clear fact that the action above is clearly unlawful, FEC responded to CLC saying they could not reach an agreement to open an investigation thus decided to close the case. The Campaign Legal Center’s deputy executive director Paul S. Ryan, tweeted, “Just when I thought the dysfunctional FEC couldn’t get any worse.”

This is not the first time shell companies were given green light to hide donors behind them. The Supreme Court’s 2010 Citizens United ruling paved the way for corporations and unions to make unlimited political expenditures. It tossed out the corporate and union ban on making independent expenditures and financing electioneering communications, allowed corporations and unions to spend unlimited sums on ads and other political tools, calling for the election or defeat of individual candidates.[ii]

Illegal campaign spending surge quickly after this ruling was published. According to Election Confidential, in the 2012 election cycle, 17% of all business money in Super PACs, totaling nearly $17 million, passed through a shell corporation and was thus not traceable to a legitimate original source. With its anonymity nature, easy-to set up process, and regulations loopholes, Shell Corporations became the perfect tool for candidates and their campaign aids to funnel illegal money into their campaign finance, and sometimes, their own pocket as well.

Shell Corporations have come into existence for quite a long time. It serves as a vehicle for business transactions without itself having any significant assets or operations. It is also called “Anonymous Company” because it’s almost impossible to track down ownership information and money transaction records. The only searchable information is a clearly-faked lettered company name like “XYZ Company” and an address that leads to nowhere. Delaware, as indicated by Stepanie Ostfeld, senior policy advisor with Global Witness, the capital of U.S. Shell Corporation[iii], and was one of the most important home for shell corporations with its loose regulations and corporate-friendly state position.

Setting up a shell corporation is easier than you think. Hiring a surrogate to file the paperwork is all you need. “In Delaware, It takes less identifying information to set up a company than it does to obtain a driver’s license or register to vote”, said Ostfeld. Most states do not require filer to report, or even retain proof of the identity of the company owner—“beneficial owner”, making tracing suspicious money almost impossible.

“If there were no campaign manager to keep a handle on spending and fees, you basically have just a few people getting together to check the box on legal structure, and they basically just divide up the money.” commented Mark McKinnon, former strategist for George W. Bush in 2000. Since Marco Rubio announced his 2016 campaign, Reclaim America paid a total of $100,751 to nine staffers and firms in 2015 that also received $1.2 million from his campaign account. Its largest expense between April and December: $32,000 paid to Terry Sullivan, Mr. Rubio’s full-time campaign manager, for “strategic consulting.” [iv]The candidate and their campaign aids made more in a year than most Americans earn in a lifetime through Shell Corporations.[v]

It is more than clear that shell corporations are harming our campaign finance system, and we need to end them, requiring that the actual owner of a company be listed somewhere available to law enforcement. Showing our support by backing the Incorporation Transparency and Law Enforcement Assistance Act (ITLEA) is one solution. ITLEA called for ending the use of shell companies, requiring companies to disclose their ultimate owners when the company is set up, and keep this information up to date. This would make it much harder for money launderers to hide their identity behind webs of shadowy companies to stash their ill-gotten gains in banks.

Your efforts and support are crucial to create a healthier and more transparent campaign finance system. Start with supporting ITLEA today, do not allow money tricks interfere our election process, and let us work together to eliminate the shady shell companies.

-YW

[i] http://www.motherjones.com/politics/2015/08/trump-just-made-case-for-campaign-finance-reform

[ii] http://www.publicintegrity.org/2012/10/18/11527/citizens-united-decision-and-why-it-matters

[iii] http://www.mintpressnews.com/delaware-remain-u-s-shell-corporation-capital/192674/

[iv] http://www.wsj.com/articles/pac-payments-raise-questions-over-rubio-campaign-finance-1454707035

[v] http://www.bloomberg.com/politics/articles/2015-05-27/bill-clinton-s-shell-company-game